Is this career for you?

Do the following statements accurately describe you?You are self-motivated, outgoing, open-minded, and enjoy learning new things

You have excellent verbal and written communication skills

You have strong analytical and judgment skills and pay attention to detail

You have (or had) a part-time job that involves decision-making and problem-solving, interpersonal and communication skills, such as a nurses aide, restaurant server or retail sales associate.

If you answered yes to these statements, then a career as a risk manager might be the perfect fit!

How do I get there?

A combination of the following qualifications would be helpful in gaining employment in the property and casualty insurance industry.

What should I take in high school?

Your high school course plan should include post secondary pre-requisites in Grade 12 English, Math, Science, and Business Studies. We also suggest computer studies, business law, and economics.

College/University

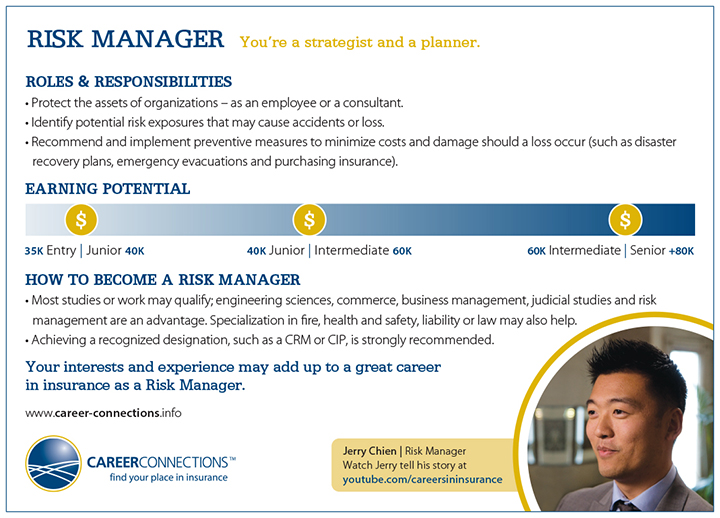

A college diploma or university degree in engineering science, commerce, business management and judicial studies are acceptable for entry into the profession, though those who have earned a degree or specialization in risk management are at a distinct advantage.

Licensing

There are no licensing requirements for this career at time of publication.

Professional Qualifications

The Canadian Risk Management (CRM) designation is recommended for a role in risk management. Learn more.

The Chartered Insurance Professional (CIP) is the property and casualty insurance industry’s comprehensive professional program focusing on technical and applied career specific knowledge. Completion of the CIP with a concentration in Claims courses would be an asset in professional development and in gaining understanding of the claims process. Learn more.

The Fellow Chartered Insurance Professional (FCIP) is the property and casualty insurance industry’s premier designation denoting a level of professionalism above the CIP. Learn more.